What is self-employment?

What is self-employment ?

The auto-enterprise is a sole proprietorship that falls under the micro-enterprise tax regime. What is self-employment ?

It facilitates the creation and management of your business and allows you to benefit from social protection.

As an auto-entrepreneur, you benefit from social security coverage in the same way as other independent workers.What is self employment

The auto-entrepreneurs are attached to the CPAM for the health insurance and to the URSAF for the collection of their social contributions.What is self-employment ?

How to obtain the self-employed status?

The auto-entrepreneur status is open to everyone!

Students, employees, job seekers, civil servants or pensioners, provided that they meet certain criteria:

– Be of age

– Have a postal address in France

– Be of French or European nationality

– Not be under guardianship

– You must not have been banned from practicing or managing your business

You can work as an auto-entrepreneur on a principal or complementary basis.

What is self

How to become a self-employed in France?

The creation of the status is very simple and takes only a few minutes. You just have to go to the URSAF website. Then go to the section « Create my auto-enterprise ».

The online creation of your status is totally free and does not require any capital contribution!

It is therefore not necessary to go through an agency or a website which sometimes charge fees for the creation process.

How to make my declaration ?

The first declaration must be made at least 90 days after the date of the beginning of your activity.

Moreover, you must declare your turnover every month or every quarter even if it is equal to zero. You must then pay the contributions and fees due.

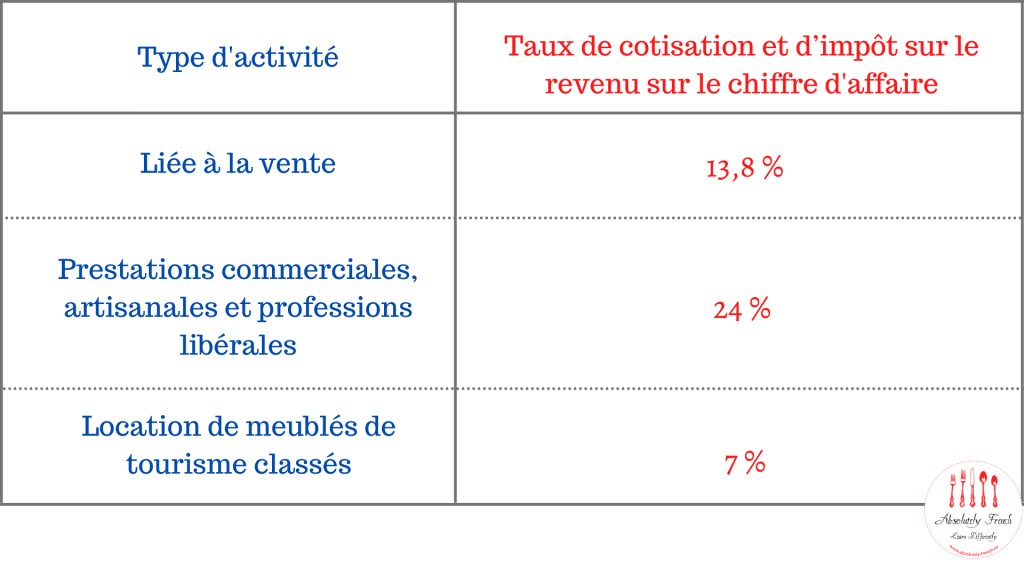

What is the contribution rate on the turnover?

The contribution rate is different depending on the sector of activity.

Declarations and payments are made online, in the « Manage my auto-enterprise » section.

If you do not have a turnover, you do not pay income tax or social security contributions.

You can benefit from aid under certain conditions thanks to the Acre. This aid allows you to benefit from reduced rates for the calculation of contributions for about 3 years.

Please note! You only have 45 days from the date of filing the application to create or take over the business to complete the application.

What documents are required to create the self-employed status?

You need a copy of your identity card or passport with the mention « conform to the original », dated and signed.

Here is an example to make it easier for you:

« I certify on my honor that this ID is true to the original. Done at … on … and your signature. »

For the status of auto-entrepreneur for a regulated profession, proof of residence or professional qualification may be requested in addition.

You may also be interested in these articles:

Why register for social security?

How to register for social security in France?

What is self-employment ?

Absolutely French is the first French language school ?? dedicated solely to expatriate spouses and expatriates.

Our main mission is to promote dual careers among expatriate couples.

With our fun, friendly and innovative French language training, we guarantee a successful integration!

Want to learn with us? Register an expatriate spouse?

Contact us !

E-mail : contact@absolutely-french.eu

Tel : 01 83 73 98 49

Address : 4, rue Faraday 75017 Paris

Comments by Absolutely

Les fêtes en France

Hello Koby, of course, you are welcome to share it ❤️

Conjoint d’expatrié, comment s’intégrer en France?

Thank you Wyatt! Are you also an expat partner? An ...

5 millions de femmes expatriées : conjoints d’expatriés

Merci Vieira Elisangela, pour toutes les femmes expatriées! Nous avons besoin ...

Alexandre Besombes – Unique Paris, conciergerie de luxe

Hello @IrenStymn, in Absolutely French or in Unique Paris? It's ...

Les fêtes en France

Thank you Gavin! We love your comment! We will continue and ...